Preface

The Editor’s Foreword

The year 2020 will go down in the history as a period of unbelievable struggle, which has brought the whole world together. The entire human race is fighting a war with an invisible enemy. Just about everything around us has undergone a sea change. The end of the battle is not in sight as yet. In fact, we have not even reached the proverbial ‘beginning of the end’. The corona pandemic can attack us through a second wave at the fall of the year, even if we can flatten the exponential curves. The global lockdown has already had a profound effect on the economy of nations. In India, millions of workers have been thrown out of jobs, and many businesses like the malls and multiplex complexes have shut shop indefinitely. The tourism and hospitality industries have bleak prospects and thousands of sports personalities, who have spent the last four years dreaming of medals in the Tokyo Olympics, will have to wait for at least one more year to show their prowess and skills.

“What next” and “what after the Corona crisis” are questions that beg for an answer. We have to look into the pages of history to see how economies were successfully ‘turned around’ in the past. The period between the two World Wars (1919 to 1939) is an interesting era. Germany was ravaged by WW1. The defeat left them shattered. But what they achieved by the year 1939, was nothing short of a miracle. My friend Thomas has been researching the life and times of Hjalmar Schacht, and produced a piece for the benefit of those who like a bit of serious economics.

*

Preface

The Coronavirus pandemic has caused a global depression worse than the Great Depression of 1929 – 39. We need to learn lessons from that depression. It was caused by deflation which was little understood at the time. India, being an agricultural economy, suffered more than most other countries. Most countries recovered only in 1939 – 40, thanks to increased production on account of World War II.

For a long time it had been a mystery to me as to how Germany recovered from the devastation of World War I, the stiff and unfair terms of the Versailles Treaty, the hyperinflation, the reparations and the Great Depression of 1939. I had read a little bit about Hitler’s dictum of using deficit financing for a fair day’s work. But I did not know any details.

The provocation for this article was a paper titled “Fiscal Options & Response to Covid-19 Epidemic (FORCE)”, which the IRS Association presented to the Prime Minister’s Office (PMO) and the Union Finance Ministry. The paper recommended raising income tax rate to 40 per cent for those who earn over Rs 1 crore a year, re-introduction of wealth tax, effecting a one-time Covid-19 cess of 4 per cent on taxable income of over Rs 10 lakh, direct cash transfer of up to Rs 5,000 a month for the poor, and a three-year tax holiday for all corporates and businesses in the healthcare sector.

The Ministry of Finance quickly distanced itself from the paper, making it clear that the paper did not represent government thinking.

Further, the Central Board of Direct Taxes issued chargesheets against three principal commissioner-rank IRS officers for “misguiding” young taxmen and “unauthorisedly” releasing the report to the media.

The bureaucracy in India is very powerful. Many of them would love to go back to the days of Morarji Desai, his 11 tax slabs and his 97.75 % rate at the highest slab of income tax. So, it is very necessary to learn from history and for the public to be aware of different ideas.

Now the internet has opened up huge vistas. What would have required months of study and visits to many libraries is now available if only we take the trouble to search. I stumbled on Dr Hjalmar Schacht and how he was instrumental in German recovery from hyper inflation, from the deflation of the Great Depression and how he co-founded the Bank for International Settlements.

Also, my editor wants me to “make some positive recommendations.”

Well, the positive recommendation is to put on your thinking caps, learn from history and decide for yourself.

====================================================================

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

====================================================================

Germany After World War I

Germany was in dire economic straits on account of losing World War I. The Treaty of Versailles imposed severe conditions on Germany and they had to pay reparations. On top of that, the Allied blockade continued for a year after the war ended. The result was hyperinflation. In 1914, the exchange rate of the German mark to the American dollar was about 4.2 to one. Nine years later, it was 4.2 trillion to one.

The central cause of the hyper inflation was the Reichsbank itself. The term of its president, Rudolf E. A. Havenstein, was for life. He kept issuing ever greater amounts of Papermark for keeping the Reich financially afloat. Finally, on 15 November 1923, the Reichsbank was made to stop monetizing government debt and issuing new money. At the same time, it was decided to make one trillion Papermark equal to one Rentenmark. On 20 November 1923, Havenstein died suddenly of a heart attack. That same day, Hjalmar Schacht, the Currency Commissioner, took action and stabilized the Papermark against the US dollar: the Reichsbank made 4.2 trillion Papermark equal to one US Dollar. And as one trillion Papermark was equal to one Rentenmark, the exchange rate was 4.2 Rentenmark for one US dollar. This was exactly the exchange rate that had prevailed between the Reichsmark and the US dollar before World War I. The “miracle of the Rentenmark” marked the end of hyperinflation.

A woman uses banknotes to light her stove – 1923

Who was Hjalmar Schacht ?

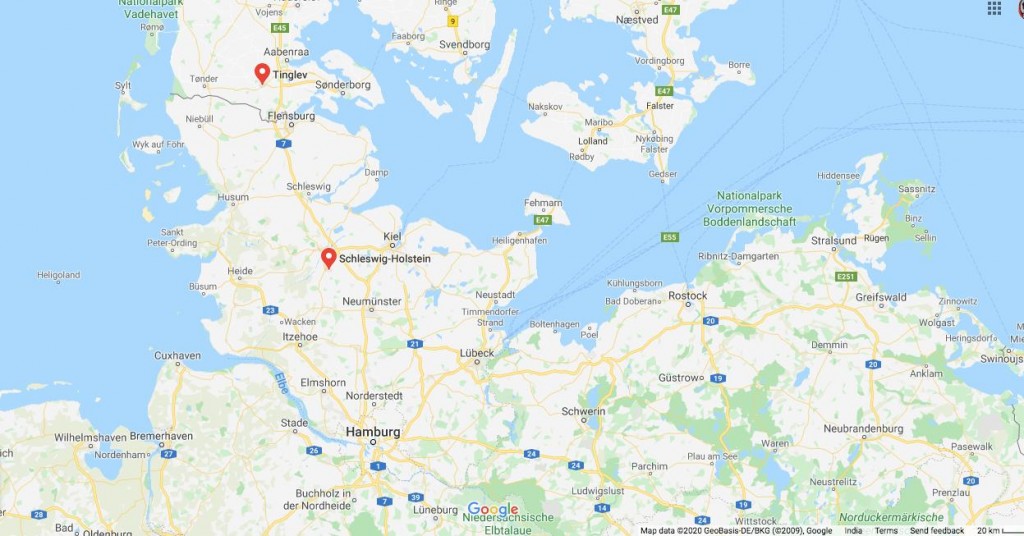

A fascinating character, Schacht was born in Tingleff (Tinglev), Schleswig-Holstein, Prussia, German Empire (now in Denmark) to William Leonhard Ludwig Maximillian Schacht and baroness Constanze Justine Sophie von Eggers, a native of Denmark.

Tingleff today

Tingleff (Tinglev) and Schleswig-Holstein

In college, Schacht studied medicine, philology, political science and finance at the Universities of Munich, Leipzig, Berlin, Paris and Kiel before earning a doctorate at Kiel in 1899 – his thesis was on mercantilism.

Schacht joined the Dresdner Bank in 1903, becoming a deputy director in 1908. From 1915 till 1922 he was a board member of the German National Bank.

Schacht was a freemason, having joined the lodge Urania zur Unsterblichkeit in 1908.

During the First World War, Schacht was assigned to the staff of General Karl von Lumm the Banking Commissioner for Occupied Belgium, to organize the financing of Germany’s purchases in Belgium. He was summarily dismissed by General von Lumm when it was discovered that he had used his previous employer, the Dresdner Bank, to channel the note remittances for nearly 500 million francs of Belgian national bonds destined to pay for the requisitions.

In 1918 Schacht co-founded the German Democratic Party. He became a fierce critic of the post-World War I reparation obligations imposed by the Treaty of Versailles.

In 1923, Schacht applied for and was rejected for the position of head of the Reichsbank, largely as a result of his dismissal from Lumm’s service. But, later that year, in response to the devastating inflation in the country the German government appointed him the Currency Commissioner and gave him near dictatorial powers over the German economy.

“He brilliantly understood the key point of psychology of money, which is as valid today as it was in the hyper-inflation of the 1920s: the appearance of financial stability creates monetary value. If people believed that someone was in charge, that the chaos would end, and that the Rentenmark had value, then it would be valued.”

Dr Hjalmar Schacht

The aim, Schacht said, was to “make German money scarce and valuable.” In this he succeeded mightily; so well in fact that a month later, on December 22nd, 1923, Schacht was promoted and became, in addition to Currency Commissioner, the President of the national central bank of Germany—the Reichsbank. Schacht went on to play a vast role in both the formation of the Bank for International Settlements (BIS) and the rise of Hitler and Nazi Germany

With the Rentenmark functioning as a currency, Schacht had brought German inflation under control. His next step was to begin the process of building a gold reserve to give the currency a more sound backing. To this end, on December 31st 1923 he travelled to London and was met at the Liverpool Street train station by none other than the legendary governor of the Bank of England himself—Montagu Norman. Norman had been governor for over 3 years and was widely considered one of the most powerful and influential men in the world.

Schacht’s best friend was Lord Montagu Norman, Governor of The Bank of England from 1920 to 1944. They were co-founders of The Bank for International Settlements in Basle.

Schacht’s purpose in visiting Norman was to obtain a loan for $25 million from the Bank of England to a new Reichsbank subsidiary, the Gold Discount Bank. The two bankers instantly took to each other and Schacht got his loan. With the loan and the implied approval of the Bank of England and Norman, world perception of Germany’s financial prospects immediately improved. This further opened financial doors in both Wall Street and London. Their meeting in London started a friendship that lasted until Norman’s death in 1950 and would have consequences that reverberate to this day.

With the assistance of these loans Germany resumed reparations payments. However, the German government, people, and particularly Hjalmer Schacht, still hated them and wanted them gone. The fact was that Germany was only able to make its payments because it was borrowing from other nations.

The Bank for International Settlements (BIS)

By 1928 Schacht felt that it was no longer feasible to keep borrowing from Peter to pay Paul. Meanwhile France, Belgium and other Allies were adamant that the reparations continue. The upshot was that a new conference to resolve the reparations issue was convened in Paris in February of 1929, this time chaired by Owen Young.

The conference got under way cordially but quickly became contentious. Schacht and the Germans proposed a complete re-structuring of the reparations schedule requiring relatively small payments of $250 million per year for the next 37 years. The French, headed by Bank of France governor Emil Moreau, demanded $600 million a year for the next 62 years. Neither man would yield from their position and the resultant impasse persisted. Despite the discord, one idea put forth by Schacht and Montagu Norman was getting some traction: the creation of a new bank for the prime purpose of managing Germany’s reparations payments. The two bankers held that the new bank would keep the issue free of politics and would manage the payments on a purely financial basis—something that was actually very unlikely, considering how politically charged the reparations issue was. In actual fact Norman had been considering similar ideas for years.

Writing later about the bank’s creation, Schacht stated: “…my idea of a Bank for International Settlements had met with such enthusiastic response from all those taking part in the Young Conference that soon there was not one among them who would not have claimed the suggestion as his own.”

Nevertheless, despite the role he played with Montagu Norman in getting the BIS established, Hjalmar Schacht declined a directorship in the BIS that would be his by virtue of his post as president of the German Reichsbank. Upset that the Young Plan did not dramatically reduce the German reparations, or eliminate them altogether, he resigned from the Reichsbank in March of 1930, turning his post as president over to former German minister of finance and Chancellor, Hans Luther.

In February of 1930 the dream of Montagu Norman and Hjalmar Schacht of a “Central Bankers Club” was ushered into reality when the foundation documents of the Bank for International Settlements were signed. As Adam Lebor reports in “Tower of Basel”: “Under the cover of the Young Plan, as well as the need for an impartial financial institution to administer German reparations payments, Norman, Schacht, and the central bankers had by brilliant sleight of hand created a bank with unprecedented powers and privileges.”

Office of the Bank for International Settlements in Basle, Switzerland

The Great Depression of 1929 – 39

The Great Depression started with a stock market crash in US in October 1929. Germany was still paying reparations and suffered greatly. And yet, Germany was the first country to recover from the Great Depression. Let us see how this came about.

Newspaper headline of the 1929 stock market crash

By January 1933 the economic situation in Germany was dire. Stocks of raw materials had been depleted, factories and warehouses lay empty, and about 6.5 million people (about 25% of the domestic workforce) were unemployed and on the verge of malnutrition, while the country was crushed by debt and its foreign exchange reserves approached zero. On 30 January 1933 after a series of parliamentary elections and associated backroom intrigues President Paul von Hindenburg appointed the leader of the Nazi party, Adolf Hitler as Chancellor. In March 1933, after the Reichstag adopted the Enabling Act of 1933, Hitler got vastly expanded powers.

Hitler appointed Hjalmar Schacht, as President of the Reichsbank in 1933 and Minister of Economics in 1934. The policies he inherited included a large public works programs supported by deficit spending – such as the construction of the Autobahn network – to stimulate the economy and reduce unemployment. These were programs that were planned to be undertaken by the Weimar Republic during conservative Paul von Hindenburg’s presidency, and which the Nazis appropriated as their own after coming to power.

From 1933-1938, thanks to Hjalmar Schacht, the economy recovered spectacularly. Schacht’s objective to jumpstart the moribund economy required money. But money was not available, since savings were inexistent and production was so restricted that savings could not accumulate. Neither could money be printed, since lending to the government would have put the Reichsbank at risk of losing control of monetary policy.

Schacht at a meeting in the Reichsbank transfer commission in 1934

Schacht then contrived a brilliant unconventional monetary solution. For payments, state contractors and suppliers received bills of exchange issued by a company called ‘MEFO’.

MEFO stood for Metallforschungsgesellschaft (Metal Research Company), a private empty-shell company with paid-up capital of 1 million marks. It was co-owned by Siemens, Gutehoffnungshutte, Rheisenstahl and Krupp, in whose names the bills were issued, so as not to weigh on the fiscal budget.

The MEFO-bills were state guaranteed, they could circulate in the economy and could be discounted by their holders at the Reichsbank in exchange for cash. The contractors accepted the bills because they could redeem them for cash at any German bank, which in their turn knew they could redeem the bills at the Reichsbank.

By tying the bills to output, Schacht was able to stimulate output, and eliminate unemployment. This historical implication has clear modern-day implications, with parallels to ‘helicopter money’ policy.

In June 1933, a programme for infrastructure development was introduced. It combined indirect incentives, such as tax reductions, with direct public investment in waterways, railroads and highways. It was followed by similar initiatives resulting in great expansion of the German construction industry and the auto industry.

In the initial phase, the recovery was not driven by the military industry and the output response was particularly strong. Thanks to the launch of large public works and the building of the country’s highway network, construction recorded the fastest absorption rate of employment (209%), followed by the automobile industry (117%) and steel (83%).

Under Reichsbank regulation, the bills had 3-month maturity and could be renewed 19 times for a 5-year period. This was necessary since economic reconstruction would require a number of years. The bills became a sort of fiduciary money flowing between firms. They were used for 4 years and reached a volume of 12 billion marks by 1938.

Schacht’s decision was also due to the fact that the conversion of MEFO-bills at the Reichsbank was putting pressure on the money supply, since banks were facing higher demand for loans while savings were drying up.

When the notes were presented for payment, the Reichsbank printed money. This proved inadequate in 1938, when a large share of Mefo’s five-year promissory notes fell due, so the government got the banks to buy government bonds, in order to pay the holders of Mefo bills. In effect, they kicked the can down the road. Meanwhile, Schacht’s administration achieved a rapid decline in the unemployment rate, the largest of any country during the Great Depression. By 1938, unemployment was practically extinct.

The money created against the MEFO-bills issued did not produce the inflation that classical theory – then as much as now – would have predicted. Supply and demand grew in parallel, leaving prices unaltered.

Schacht took justifiable pride in having successfully financed German recovery from the Great Depression while keeping inflation under control. As described by Adam Lebor in “The Tower of Basel,” by 1939 Schacht had succeeded mightily: “Schacht had wrought a miracle,” Lebor says, “—a centrally planned economy that was not ravaged by inflation, a worthless national currency or unemployment. In the six years since Hitler had taken power, unemployment had been reduced from 6 million to around 0.3 million. Armies of the jobless were diverted to massive programs of public work—building the new network of motorways, gigantic public buildings, and planting forests.”

Schacht Parts Ways With Hitler

While Schacht was for a time feted for his role in the German “economic miracle”, he opposed Hitler’s policy of German re-armament insofar as it violated the Treaty of Versailles and (in his view) disrupted the German economy. His views led Schacht to clash with Hitler and Hermann Göring. He was dismissed as President of the Reichsbank in January 1939. He remained as a minister without portfolio, and received the same salary, until he was fully dismissed from the government in January 1943.

In 1944 Schacht was arrested by the Gestapo after the assassination attempt on Hitler on 20 July 1944, because he allegedly had had contact with the assassins. Subsequently, he was interned until the end of the Third Reich in the concentration camps Ravensbrück and later at Flossenbürg. In the last days of the war, he was one of the 134 special prisoners who were transported by the SS from Dachau into the “Alpine Fortress” of Niederdorf in South Tyrol, where they were freed on 30 April 1945.

Austro-Hungarian Army barracks in Niederdorf

Despite this, he was tried at Nuremberg, but was fully acquitted. A de-Nazification court in Stuttgart subsequently sentenced him, however, to eight years’ labour camp as a “Major Offender”. Shortly afterwards, on 2 September 1948, following an appeal, Schacht was acquitted by a Ludwigsburg court and released. He was definitively cleared in November 1950 of all charges connected with his involvement in the Third Reich.

Second Career

After he was cleared of all charges, Schacht began a highly successful second career in the 1950s as a financial adviser to developing countries such as Brazil, Ethiopia, Indonesia, Iran, Egypt, Syria and Libya. In Indonesia his advice led to the “Benteng Policy”. Its template became the basis of today’s Malaysia New Economic Policy since 1972.

Hjalmar Schacht & Mohammad Mosaddegh

(M Mosaddegh was the 35th Prime Minister of Iran, holding office from 1951 until 1953, when his government was overthrown in the 1953 Iranian coup d’état.)

He also made a second personal fortune, founding his own foreign trade bank Deutsche Außenhandelsbank Schacht & Co. in Düsseldorf in 1953. In the 1960s he continued to be involved in problems of development aid, maintaining close ties with government and business circles in Indonesia and West Africa.

Schacht’s settling of accounts with his past appeared under the title Abrechnung mit Hitler (1949) (English title Account Settled) and his autobiography, 76 Jahre meines Lebens (My First Seventy-Six Years) was published in 1953.

Schacht died in Munich, Germany, on 3 June 1970.

Books

Schacht wrote 26 books during his lifetime, of which at least five have been translated into English:

-

The Stabilisation of the Mark (1927)

-

The End of Reparations (J. Cape & H. Smith; 1931)

-

Account Settled/Abrechnung mit Hitler (1949) after his acquittal at the Nuremberg Trials

-

Confessions of the Old Wizard, (Boston: Houghton Mifflin, 1956)

-

The Magic of Money, (London: Oldbourne, 1967)

-

My First Seventy-Six Years (autobiography), (Allan Wingate, 1955; online)

For Further Reading:

1. Guillebaud, C W (1939), The Economic Recovery of Germany from 1933 to the Incorporation of Austria in March 1938, Macmillan and Co.

2. Mahe, E (2012), “Macro-economic policy and votes in the thirties: Germany (and The Netherlands) during the Great Depression”, Real-World Economics Review Blog, 12 June

3. Paying the piper, reaping the returns

Hans-Joachim Voth 18 September 2008

4. Ahamed, Liaquat. Lords of Finance: The Bankers Who Broke the World, Penguin Books, 2009 ISBN 978-1-59420-182-0

5. Weitz, John. Hitler’s Banker: Hjalmar Horace Greeley Schacht. Boston: Little, Brown and Co. 1997. ISBN 0-316-92916-6.

6. Braun, Hans-Joachim (1990). The German Economy in the Twentieth Century. Routledge.

7. The Bank for International Settlements

https://www.bis.org/

8. The Weimar Republic 1918-1929

https://www.bbc.co.uk/bitesize/guides/z9y64j6/revision/5

9. 90 Years Ago: The End of German Hyperinflation

https://mises.org/library/90-years-ago-end-german-hyperinflation

10. Adolf Hitler’s rise to power

https://en.wikipedia.org/wiki/Adolf_Hitler%27s_rise_to_power

11. Biography of Hjalmar Schact

https://en.wikipedia.org/wiki/Hjalmar_Schacht

12. Macroeconomics in Germany: The forgotten lesson of Hjalmar Schacht

Biagio Bossone, Stefano Labini 01 July 2016

13. Secret Meeting of 20 February 1933 https://en.wikipedia.org/wiki/Secret_Meeting_of_20_February_1933

(This meeting provides further evidence of the financing of the Nazi Party by big business.)

14. Nuremberg Trial Defendants: Hjalmar Schacht

https://www.jewishvirtuallibrary.org/nuremberg-trial-defendants-hjalmar-schacht

15. Economy of Nazi Germany

https://en.wikipedia.org/wiki/Economy_of_Nazi_Germany

16. Hitler’s Bank: The Unknown Story of the Bank for International Settlements-Part IV—by Mark Arnold

http://fromanativeson.com/2016/11/07/hitlers-bank-the-unknown-story-of-the-bank-for-international-settlements-part-iv/

17. 1922-1923 Hyperinflation in Germany

https://mashable.com/2016/07/27/german-hyperinflation/

18. WW II Gravestones — Schacht, Hjalmar Horace Greeley

https://ww2gravestone.com/people/schacht-hjalmar-horace-greeley/

19. HJALMAR HORACE GREELEY SCHACHT: “HITLER’S MONEY MAN”

https://excatholicsforchrist.com/hjalmar-horace-greeley-schacht/

20. Benteng program

https://en.wikipedia.org/wiki/Benteng_program

21. Malaysian New Economic Policy

https://en.wikipedia.org/wiki/Malaysian_New_Economic_Policy

22. Find a Grave — Horace Greeley Hjalmar Schacht

https://www.findagrave.com/memorial/23718729/horace_greeley-hjalmar-schacht

23. How income tax slabs have changed since Independence

https://economictimes.indiatimes.com/wealth/tax/how-income-tax-slabs-have-changed-since-independence/1974-75/slideshow/67582763.cms

Videos:

1. Hjalmar Schacht – The Banker of The Third Reich

https://www.youtube.com/watch?v=f-Xnb2F1iWY

2. Hjalmar Schacht – The financial wizard of the Third Reich

https://www.youtube.com/watch?v=VIH9c4CVMYI

3. Hjalmar Schacht — Hitler’s Banker

https://www.youtube.com/watch?v=F4dVTCG4QCU

4. Hjalmar Schacht, Reza Shah and the Nazi New Order in Iran, 1933-1941

https://www.youtube.com/watch?v=I6PNGCh5Sn8

5. Hjalmar Schacht, Hitler’s Banker & The BIS in Basel

https://www.youtube.com/watch?v=6gz2EEiaESI

6. Schacht’s New Plan (1933)

https://www.youtube.com/watch?v=eeBw3DpJ0So

7. Hitler and Hjalmar Schacht 1933-34

https://www.youtube.com/watch?v=tKkP89iGMLo

8. Lords of Finance: The Bankers Who Broke the World – Financial Crisis (2009)

https://www.youtube.com/watch?v=4wl30rHVAtI

9. Nuremberg Trial Acquittals (1946)

https://www.youtube.com/watch?v=-YT-T9bBqH0

10. Hjalmar Schacht Quotes

https://www.youtube.com/watch?v=AsUEtX4OJ7M

11. “Mémoires d’un magicien”, de Hjalmar Schacht (in French)

https://www.youtube.com/watch?v=s0X0mmPwwRk

Sir, thanks for sharing. fascinating and absolutely topical. Thanks to Wg Cdr Thomas.

Aping the Brits and now the Americans have gone too far for too long. The out of reality elitist approaches in economics and general administration are leading us nowhere. Most of these so called elites are products of clones of British or American Universities. Their toolbox of American text book solutions do not fit the near crisis situations in Indian agriculture, industry or even in the field macro economics.

Very interesting!

Anil and Sunita

In anticipation, we have already tightened our belts.

The car has not moved an inch since 19 March 2020

The driver says he will get bored to death if he has to sit all day. He has left, and is busy with the small piece of land in his village.

The gardener has gone back Bihar. Now we water the plants with a pipe. Some plants have died (corona casualty)

We have given up fish; the only non-veg we ate till the Corona

There is a general ban on buying anything other than groceries and fresh food

We are growing some things at home : salad leaves, spring onions, pudina, dhania and tulsi etc

We are ready for a pension cut. In Urdu they say,

“आता है जो तूफाँ आने दो

कश्ती का ख़ुद हाफ़िज़ है

मुश्किल तो नहीं इन मौज़ों में

कहीं तैरता साहिल आ जाये !

(Maujon means waves and saahil is the bank of the river/ocean)

So, no fear!

2997

Well done

says 2333 CSM

EASY me

open sesame……

I am nearing 80 this July

all say hold on we will celebrate your B’day

more also increase in Pension 15 PERCENT Do help us please .

lol I stay inside doors

crawl on the floors

YOGA they say will help me

I prefer crawling

keeps all ”ungs”

FIT

2997Easy, you have compelled me to ponder over this. A brief comment will not be enough. I will have to write a full article.

Lockdown 4.0 has been promised. We need to look at Lockdown (n+1).

Very well researched article. I think Schacht may have been a pioneer in devising ways and means of financing development activities at national level while having a system which effectively postpones the payment of bills; what the author has aptly termed “kicking the can down the road”. In modern times, US has mastered this technique…the most developed nation is also the nation most in debt. To tackle the corona pandemic, Trump has already given a fiscal stimulus of the order of 10 times the US GDP. In India, our policy makers are very conservative, probably weighed down by the international rating agencies breathing down the neck. So the challenge in our context is to give financial incentives for production and manufacturing so as to reduce unemployment and tackle poverty while innovatively raising funds whose repayment is spread over many years. Time for another tranche of Sovereign bonds/NRI Bonds? We will soon get to know the prescription !!.

Hi Tommy , I am most impressed, I didn’t know your hidden talent.

U r a warrior Intellectual now.

Well researched n well done,

Congrats,

Dush

A great research!

Thanks

Manmohan

Sriram Jayasimha

Dear General,

Thanks for this. I however think the rot in the Indian system precedes the pandemic, so getting it “back on rails” seems out of question. But opportunities do abound.

Since independence, we have favoured opiniated punditry and sophistry as compared to quiet individual action (and due rewards to producers in the economy). Also, the frenzy with which we have expanded our “cities” (really semi-slums) drawing migrant labour from the hinterland was waiting for a natural or man-made calamity to reverse (and fortunately that has happened). My hope is that they obtain improved health and by working the fields with dignity. Our agricultural output needs to increase and our consumption of exotic imported foods (such as edible oil) need to decrease. I also hear of plans to partially re-employ this workforce to improve rural infrastructure (and that is a good thing).

As consequence of the pandemic, government babus will likely become dis-empowered.. They had choked private industry for decades and their expansion needed to be stopped anyway (and this calamity might have done just that). They should be the first to be discharged as public finances collapse and, hopefully, they will also play a part in rural revival as their city jobs disappear. The service sector consisting of accountants, lawyers, financial “industry” employees, restaurant and hospitality workers will also decline.

Last, we are an overweight (yet poor) nation with chronic levels of lifestyle-related disorders (such as obesity, hypertension and diabetes). Hopefully, this disaster, together with reduced pollution levels, will improve public health in the medium-term. We might just have to thank the pandemic for bringing about a transition to healthy and outdoorsy vocations!

Best wishes.

Sriram

Reflections… Abstractions…

Good job, Joseph.

A history lesson, which showed me how ignorant I was about such things.

And also made me realise that there are lots and lots more stuff that I’m ignorant about.

Good that you are keeping busy with what I don’t understand. But I liked the introductory profile photo as the starter. Keep writing.

Very useful – and important lessons for the present time!

Thanks for sharing!

I have been living in Canada since 2005 .

My main observations after I have spent some time visiting major cities of USA.

NEW YORK CHICAGO BOSTON NEW JERSEY and a few more is

Please excuse me for being thoughtless and outspoken.

ONE THERE IS A TOTAL DIFFERENCE OF CULTURES.READ THIS TEN TIMES .

THEY ARE VERY RICH WITH LESSER POPULATION

ONE USA DOLLAR IS 70 INR AND CDN =55INR APPX as of now.

THEY HAVE THE NATIONS EXISTENCE AND WELL BEING ALWAYS IN MIND IRRESPECTIVE OF LEADERS .THEY HAVE NO RAJAS AND MAHARAJAS LIKE WE HAD AND IN TRANSFORMED FORM STILL HAVE .

WHY IGNORE OUR CULTURE. WE HAVE INCLINATIONS ALWAYS .

ONCE FOR 200 YEARS WE HAD THE BRITISH RAJ , WE FOLLOW INDIRECTLY STILL.

WE PUT ON STREET LIGHTS AT TIMINGS THEY FOLLOW AND POLES ARE AT DISTANCES AS THEY HAVE IN THEIR COUNTRY.

HAS ANYONE REALISED THAT IT GETS DARKER IN CLOUDED COUNTRIES even during cloudy days —-MORE LIGHT IS NEEDED . DO WE NEED TO LIGHT OUR ELECTRIC POLES SO EARLY AND SWITCH OFF AFTER SUNRISES

JUST WORK ON THIS SINGLE POINT ONLY YOU ALL ARE BRAINY WILL YOU SAVE POWER AND MONEY…EXCUSE THE MR DOUBTFULLS

I AM ONLY A BORN CHARLIE…NDA KIND 1959 nearing 80

FURTHERMORE THEY ARE MORE WHITE SKINNED RICH NEED COMFORTS HENCE 24 HOURS HEATING AND OR AC .CAN WE REALLY AFFORD IT EVEN IN MALLS…

THE MOST IMPORTANT ASPECT WE ALL TEND TO IGNORE IS THE VAST DIFFERENCE IN POPULATIONS…. .

OUR CULTURE CONTINUES TO SEE THE WELFARE OF OUR SEVENTH GENERATION THE WEST SENDS OFF KIDS GIRLS AND BOYS AT 18 TO BECOME INDEPENDENT EARN OR DIE….

FIRST STUDY OUR BACK GROUND AND NEEDS OF A POPULATION AS LARGE AS INDIA’S

JUST COMPARE THE POPULATION OF THE WHOLE OF CANADA AND DELHI ONLY.

NOTE THERE IS NO POLLUTION IN THOSE COLDER COUNTRIES A DEGREE’S INCREASE in WARMING –THEY SAY GLOBAL WARMING .

MY PERSONAL VIEWS REMAIN AS EVER BEFORE BEING AN ISOLATED IDIOT TO THINK ALL ALONE

AND THAT IS APPLY YOUR MINDS TO TWO MAIN THINGS

POPULATION AND CULTURE

RATHER THAN APE AS WE DID RUSSIA IN 1971 AND NOW AMERICA

THERE HAS BEEN NO DIFFERENCE IN MENTAL CULTURE OF OUR LEADERS .

GOD BLESS INDIA .

TRY AND ELIMINATE ”’YES MEN” WE ALL STILL LOVE SO DEARLY IN ALL WALKS OF LIFE CLEARLY

Get Feed Back– good and bad then as a ”Team” take a decision

the ECONOMY WILL BE RECOVERED GRADUALLY

TAX THE EXTREMELY EXTREMELY RICH FIRST.

DON’T ENCOURAGE THE BPL MORE THAN USUAL MINIMAL…FREE THIS AND THAT

THEY MUST EARN THEIR LIVING — NOT RELY ON OUR NATIONAL GDP MAINLY

Please excuse me I speak too fastly

GOD BLESS US ALL

BHARAT HIDUSTAN INDIA KE JAI AND VIJAY

SORRY FOR CAPS NOT SHOUTING HALF BLIND

Respect your reply.

We always do take a solution and apply blindly.

We have over 10 million workers roaming around on the roads to reach their homes. We could not plan any better.

Moving this elephant will require new thinking out of the box applicable to India.

Good to know you are enjoying yourself in Canada. The best country to live in. Just read that in the paper today.

Lot to understand and complex subject..

Recovering economy of countries..

Though depends on various parameters..

But

A brilliant leader with a team of brilliant economists..

Can lead to success

But

That leader must listen to advises.. Which must be open and public feed backs..

But

Unfortunately..corrupt politicians and dirt filled

Politics are playing havoc in the system

And

These days

Leaders have become monarchs..

Not ready to listen..

My view

Equally stunning is Germany’s rise from rubble as Europe’s economic powerhouse after their unconditional capitulation in WWII.

https://www.dw.com/en/docfilm-world-war-two-capitulation/av-53348015?fbclid=IwAR1NbeqgQ3AhbAyduOjWF2nBMznIrl1mUlFKvCxi6gI0o_r_HOCkkWY4Xoc

Very interesting look into Economic History and completely new for me. It’s well written and I am sure we will find something in it to talk about when we chat.

Thanks for the article. It made interesting reading although most of it went right over my head !!!!

Hi Surjit ,

Thanks for sharing excellent paper .

I hope INDIA learns a lesson and manages

to come out from impending depression .

We have long way to go .Let’s hope for

the best .

With best wishes .

ABS Sidhu

A very well researched article written in easily understandable language and gripping style.

Thanks for sharing

Excellent article Sir!

One can indeed go back to the history for lessons.

Thank you

Warm regards

Paramjit

I think this researched piece calls for a sequel. The government can not be expected to do all the thinking. Their principle priority is to stay in power. But they need to take steps which lead us in the right direction.

It is not the business to get into business. But they have the power to collect taxes; and they must devise a method by which they impose the ‘right’ rate of tax, and cast the tax net on the ‘right’ people. Having collected the money, they must spend it in the best interest of our countrymen. Through these means, they can encourage the form of economic activity which is the best suited for us.

As of now, we have been aping the Americans. We are building airports, shopping malls, multiplex cinema halls and centrally air-conditioning huge buildings. To reduce construction costs we have been encouraging migrant workers to come out of the villages and live in the already over-crowded cities. The ‘economy’ is measured in terms of GDP and it is evaluated in terms of the energy consumed, factory output and services rendered.

Education is the responsibility of the government. We have created thousands of engineering colleges, in which the students do not acquire any marketable skill. They come out disillusioned. I think someone needs to address all these issues in a sequel to this very well researched paper. I am sure we have a Hjalmar Schacht hidden somewhere in our 1370 million Indians. Let us find him, and ask him to lead us.

Surjit

Very interesting! Will take me more than two readings to understand the masterly analysis of ‘financial chicanery/machinations’ fully.

As you know, in matters of money, I am a dud!

Yogi

harinder singh bedi

Very interesting, thanks for sharing.

Harindar

The most important part I got from reading this revaluation story is, A FACE PEOPLE TRUST who is controlling the central bank.

We do not have it now or will have in future. Noble laureates have bees sidelined for lack of will to listen to sound experience and knowledge.

Rest can be achieved in our country.

This world has survived

over millennia

why won’t it extract now

I wonder

why the doubt

just have a Will

Time will surely kill

all thinkers of ill

When it comes to Himalayan exploration and survey, Nain Singh is a legend. Govt have issued a stamp in his honour.

When I started on this article, I had not even heard about Hjalmar Schacht. But the internet searches showed that he is well known in the Western world. While John Maynard Keynes is usually credited with the theory behind recovery from deflation, I find that he appears to have borrowed heavily from Hjalmar Schacht. And, as you can see from the list of videos, at least one French source calls Schacht a magician.

Without a doubt, the Germans achieved a miracle. I had read about the incredible inflation which they experienced soon after the war. They changed their currency at least twice. And then there was ‘the great depression’ after the 1929 wall street collapse. German names are tongue twisters and Hjalmar Schacht took me a while to pronounce. I learnt it courtesy Google. And then I read the story. A few years ago, Thomas had pulled out the unknown name of Nain Singh…and now here is another less known Freemason who created a place for himself in the German history. Let us hope that we will be able to produce a similar economist to pull us out of mess created by the Corona pandemic!